Port of Houston offers important export channel for U.S. Soy

Farmer leaders from the United Soybean Board, Soy Transportation Coalition and Midwest QSSBs toured the Port of Houston to see progress in an investment to expand the facility. When completed the port will export soybean meal and whole soybeans. It will also offer another option when water levels of the Mississippi River are low.

Soybean farmer leaders visited Houston recently to present a ceremonial $275,000 check to The Andersons Inc., supporting an expansion project at the Port of Houston that will enable soybean meal exports beginning in early 2026. The investment, funded through the Soybean Checkoff, specifically funds research, analysis, pre-engineering and design of the facility.

The funding comes from a partnership of farmer organizations: the United Soybean Board, Soy Transportation Coalition, Iowa Soybean Association, Kansas Soybean Commission, Missouri Soybean Merchandising Council and Nebraska Soybean Board. The investment underscores how the Soy Checkoff is used to address infrastructure gaps in the soybean supply chain.

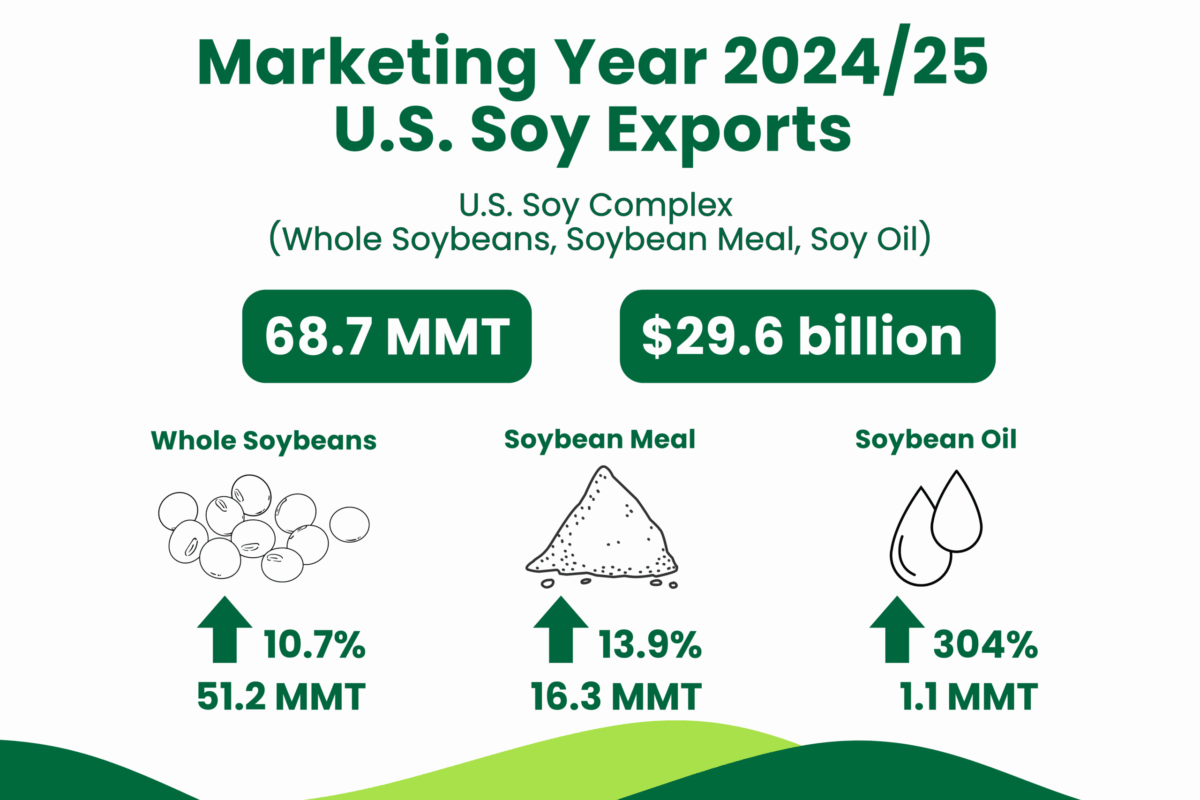

“Soybean farmers have seen a proliferation of processing facilities across the country, largely inspired by the growing demand for soybean oil in renewable fuels,” said Mike Steenhoek, executive director of the Soy Transportation Coalition. “But because of all that processing, there will be significant volumes of soybean meal that need to find a destination. While a lot will be consumed domestically, we need to be able to export a considerable amount in the future.”

Alternate Export Routes

For the fourth consecutive year, low water levels on the Mississippi River disrupted grain exports from the upper Midwest this fall. The Port of Houston expansion offers an alternative shipping route that does not rely on inland waterways. By using rail lines such as BNSF and Union Pacific, soybean meal can reach export terminals without the constraints of river conditions, strengthening supply chain resilience and reducing transportation risk.

“We’ve been so reliant on the Mississippi River, but we’ve had weather issues in the past, so we need to look at other ports, whether it be East Coast or West Coast,” said Susan Watkins, a soybean farmer from Virginia and United Soybean Board director. “We will continue to move products through our waterways down to New Orleans, but this is another avenue that opens up more markets using rail transportation. Not only will the Port of Houston move our whole soybean, but it moves our meal product as well. We need to push that pile, and they’re envisioning this will be a great opportunity for exports which would benefit all soybean growers throughout the nation.”

Steenhoek said the project addresses three of the most pressing priorities for the soybean industry: expanding meal export capacity, diversifying transportation channels and cultivating new international buyers.

“One of the old axioms in supply chains is, don’t put all of your eggs in one basket,” Steenhoek said. “The more you can spread your eggs across multiple baskets, the better position you are as an industry. Facilities like this allow us to do that, still exporting from the Gulf, but via rail instead of the inland waterway system.”

China recently agreed to purchase U.S. soybeans, but farmers continue to diversify their export partners worldwide.

“Another major topic among farmers is diversifying international markets,” he added. “China has been a substantial market, but there are headwinds. So if China is a home-run market, what are the base-hit markets? You can win baseball games via base hits, and that’s what facilities like this enable us to do — tap into those healthy, growing regions such as North Africa, the Mediterranean and Europe.”

Increasing Soybean Meal Export Capacity

One of the significant developments in the U.S. soybean industry continues to be the investment in processing facilities to produce more soybean oil for renewable fuels. The additional production of soybean oil will result in increased production of soybean meal. While much of this additional soybean meal will be consumed by the domestic livestock industry, it is increasingly essential to invest in export capacity to reach international markets.

“They have a vision that we have to move meal,” Watkins said. “Not only will they move our whole soybean, but they are looking to move the meal product. We need to push that pile, and they’re envisioning this will be a great opportunity for them to do it out of the Port of Houston — and that would be beneficial for all of the soybean growers throughout the nation.”

Increasing Resilience of the Supply Chain

Given the challenges of recurring low water conditions on the Mississippi River and the collapse of the Francis Scott Key Bridge in Baltimore, it is important to diversify shipping routes.

“When farmers visit facilities like this, they don’t have to guess whether they’ll benefit from the investment,” Steenhoek said. “This isn’t a report gathering dust on a professor’s bookshelf. You can see the infrastructure improving. You can see that in the future, soybean meal will be stored here and conveyed onto a ship. Farmers can feel good knowing their checkoff dollars are resulting in tangible improvements.”

Diversifying International Markets

As global trade shifts, U.S. soybean farmers are expanding relationships beyond traditional partners. The identified markets for the Houston export terminal include the Middle East, North Africa, the Caribbean, Latin America and Asia.

“The Port of Houston is going to be tapping into Central America or Asian markets — maybe African or European markets,” Watkins said.

With a storage capacity of 6.3 million bushels, the Houston facility supports the export of more than 2 million metric tons of grain annually and will include up to 22,000 metric tons for storing soybean meal for export.

The Andersons projects that the primary states supplying soybean meal to the facility will be Iowa, Kansas, Minnesota, Missouri and Nebraska. Other states may feed into the facility as well, given the expansion of soybean processing throughout the country.

“There’s great value in our Soybean Checkoff investment in infrastructure in the United States,” Watkins said. “We have to stay competitive, and we need to stay ahead at all times. We need to move our product and supply our customers with a reliable product coming out of different areas that will support their needs in a timely manner.”

Steenhoek said projects like the lower Mississippi River dredging project, updates to locks and dams along the river and the expansion at the Port of Houston wouldn’t be possible without the Soybean Checkoff.

“The Soybean Checkoff can be a catalyst to help draw greater funding,” he said. When we leverage those dollars, we’re able to prompt and encourage additional investments much larger than what we could provide alone.”

The funding will be used toward research, analysis, pre-engineering, and design expenses. The Andersons, the owner of the facility, will assume the cost of construction.

“We sincerely appreciate the opportunity to work with soybean farmers on this important investment,” said Matt Dvorak, Houston business manager at The Andersons.“ As domestic soybean crush increases, we are identifying new opportunities for the export of soybean meal via our Houston facility. We look forward to working with the Soy Transportation Coalition and the broader soybean farmer community on this project, which will help connect U.S. soybean meal with international customers.”