U.S. Soy exports continued to grow in marketing year 2024/25

Farmer-funded Soy Checkoff investments continue to support demand growth across global markets

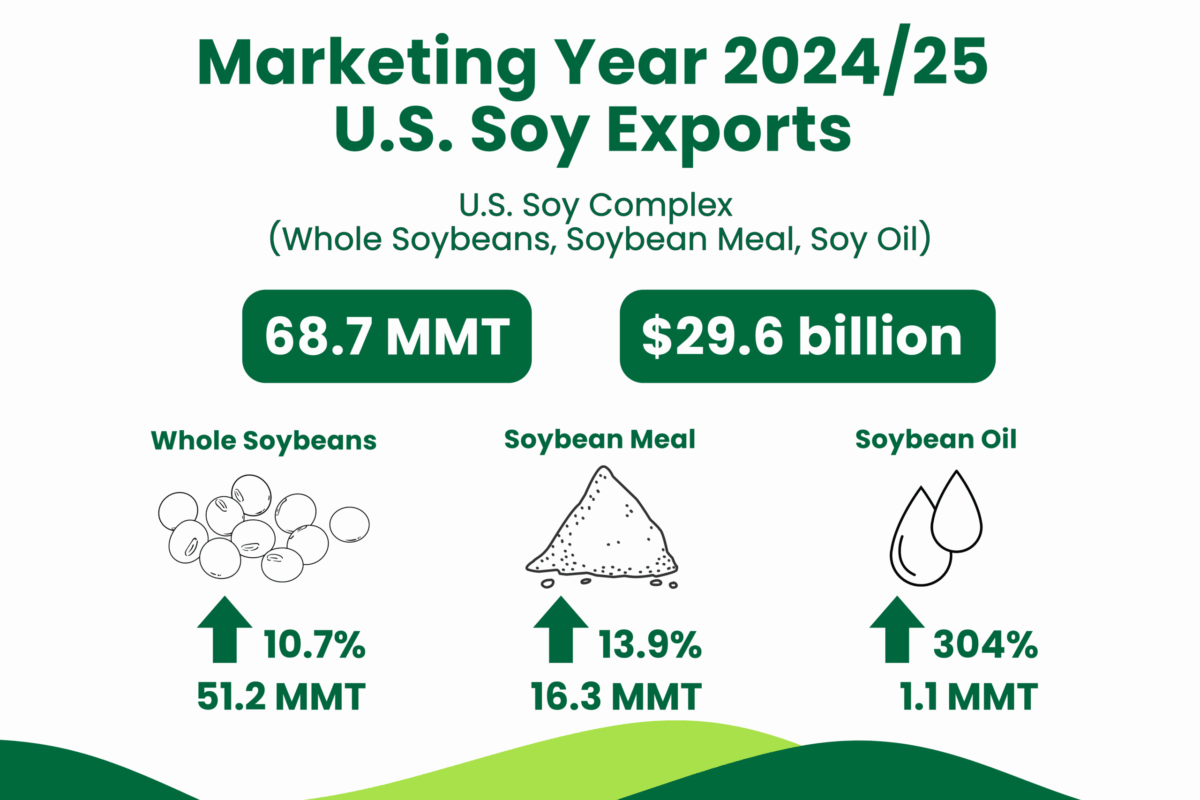

- Total U.S. Soy complex (whole soybeans, meal and oil), 68.7 million metric tons (MMT), valued at $29.6 billion.

- Whole soybeans, 1.88 billion bushels or 51.2 MMT, valued at $22.3 billion

- Soybean meal 16.3 MMT (another record year), valued at $6 billion

- Soybean oil, 1.1 MMT, valued at $1.2 billion

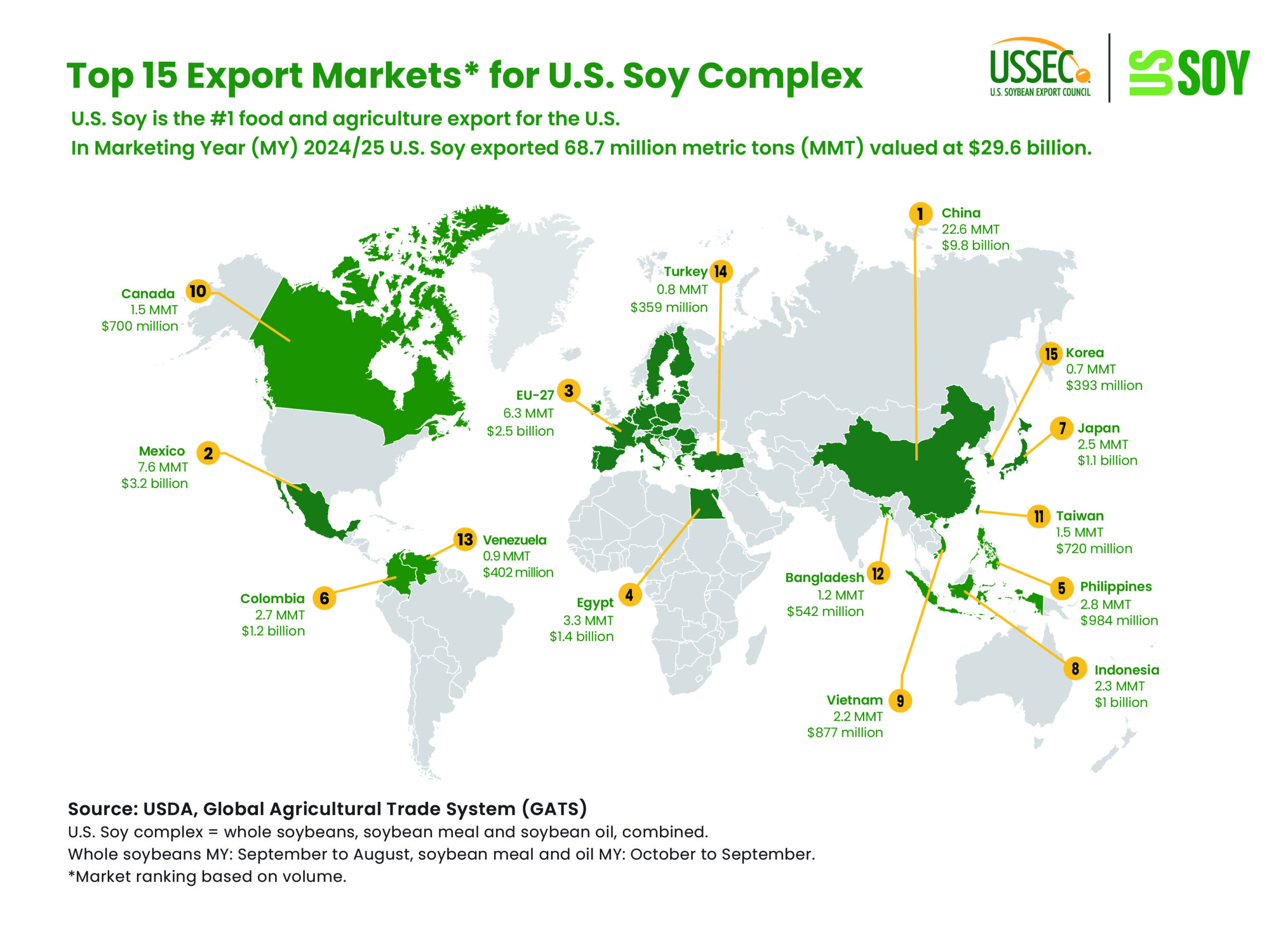

- Top five markets for U.S. Soy complex: China, Mexico, European-Union, Egypt and Philippines

CHESTERFIELD, Mo., Jan. 26, 2026 — The United States exported 68.7 million metric tons (MMT) of U.S. Soy (whole soybeans, soybean meal and soybean oil) during marketing year (MY) 2024/25. That represents a 12.8% increase year-over-year (YOY) and a 2.95% gain over the 5-year average, according to data from the U.S. Department of Agriculture Global Agricultural Trade System (USDA GATS).

This increase is supported by export expansion across all three categories:

- Whole beans up 10.7% YOY at 1.88 billion bushels or 51.2 MMT.

- Soybean meal up 13.9% YOY at 16.3 MMT (record exports in this category).

- Soybean oil up 304% YOY at 1.1 MMT.

“Strong export pace in 2024-2025 shows the value U.S. Soy offers customers around the world,” said Mike McCranie, U.S. Soybean Export Council Vice Chair, United Soybean Board Director and South Dakota farmer. “Despite uncertainty with China, this increase reflects years of strategic, farmer-led investment and collaboration across the agriculture industry to grow global demand for U.S. Soy. By supporting export initiatives through the Soy Checkoff, U.S soybean farmers have contributed instrumentally in the expansion of U.S. Soy exports into more than 90 markets, opening new doors globally for U.S. agriculture.”

U.S. Soy provides value through its sustainability, consistency and reliability to downstream customers while demonstrating lower moisture content, excellent amino acid profile and greater energy content, compared to soy from other origins. Ultimately, this increases food and feed opportunities across developing, emerging, expanding and mature markets, maximizing economic return. Beyond exports and trade development for U.S. Soy, the Soy Checkoff also partners to raise consumption of U.S. meat, poultry, and eggs around the globe, which increases the demand for U.S. soybean meal in domestic animal diets.

“With ample production and supply capacity, the United States remains well positioned to meet both domestic and global demand for whole soybeans, soybean meal and soybean oil.” said Jim Sutter, Chief Executive Officer for the U.S. Soybean Export Council (USSEC).

“When it comes to U.S. Soy exports, trade flows continue to shift across regions, yet global demand remains strong and increasingly diversified,” Sutter added. “Growth across the Americas, Middle East and North Africa, South Asia and Southeast Asia continue to expand and reinforce the importance of broad-based demand for high-quality, sustainable protein.”

“Additionally, lower soybean prices — while not favorable for U.S. farmers — offer a value to buyers in international markets to experience the high quality and positive attributes of U.S. Soy, which serves to build demand now and in the future.”

The top five growth markets for the U.S. Soy complex during the past five years, according to data from USDA’s GATS were: Turkey, up 342%; Vietnam, up 89%; Venezuela, up 68%; Colombia, up 48%; and Bangladesh, up 40%.

Sutter noted that gains in several markets reflect a mix of improved market access and rising demand for animal protein.

“The significant increase in U.S. Soy exports to Turkey is driven by the resolution of a market access issue and growing domestic demand,” Sutter said. “During the 2019/20 and 2020/21 marketing years, Turkey restricted imports of genetically modified soy, limiting trade flows of U.S. Soy.”

In Venezuela, the upward trend can be attributed to strong expansion in poultry production and consumption.[1] “Overall, growth markets for U.S. Soy are showing increasing per capita protein consumption. As countries scale up poultry, pork, aquaculture and other livestock production, USSEC representatives engage with nutritionists to demonstrate the nutrient value of different formulations utilizing U.S. Soy,” Sutter said. “We bring technical expertise to dozens of markets around the world.”

Bangladesh has also materialized as a rapidly expanding market, driven largely by its developing poultry and aquaculture sectors[2]. That demand has supported new investments in the local crush industry, which added capacity in 2025.

Sutter added that growing global demand has helped absorb increased U.S. soybean meal supplies tied to rising domestic crush capacity.

“Last year, there was uncertainty about whether global markets could absorb additional soybean meal,” Sutter said. “But we saw a consecutive year of record exports of U.S. soybean meal, with 16.3 MMT exported.”

Most of that soybean meal landed in Philippines, Mexico, Colombia and Canada. Sutter added,

Soybean oil exports also rose sharply, led by purchases from India, the world’s largest importer of vegetable oils[3]. The top five markets for U.S. soybean oil in MY 2024/25 were India, Mexico, Colombia, Venezuela and Dominican Republic. “It is good to see this strong demand for oil exports providing an alternative to domestic demand when appropriate,” Sutter said.

“While uncertainty continues to impact international trade, one thing is clear: global demand for soy is strengthening,” Sutter said. “As a source of high-quality, sustainable nutrition, U.S. Soy is an excellent solution to help meet the demand, enabling sustainable food and nutrition security.”

USSEC’s role is to work in markets around the world to ensure customers understand the U.S. Soy advantage and how to source it.

The United Soybean Board (USB) is a farmer-led organization that directs Soy Checkoff investments creating value for U.S. soybean farmers through education, promotion and research. Through strategic research and partnerships, including the U.S. Soybean Export Council, USB helps farmers adapt to global change, enhances on-farm resiliency and champions U.S. Soy in the food, feed, fuel, industrial uses, exports and sustainable production market segments. To learn more about U.S. Soy, visit USSOY.org.

###

About United Soybean Board

United Soybean Board’s 77 farmer-leaders work on behalf of all U.S. soybean farmers to increase demand, drive on-farm resilience and ensure farmers achieve maximum value for their Soy Checkoff investments. These volunteers create value through strategic partnerships across research, promotion and education investments – spanning the food, feed, fuel, industrial uses, exports and sustainable production market segments. USB also focuses its communication & education efforts on strengthening the reputation of U.S. Soy with customers, amplifying checkoff investments to inform U.S. soybean farmers and partnering with the 30+ Qualified State Soybean Boards on research and outreach. As stipulated in the federal Soybean Promotion, Research and Consumer Information Act, the USDA Agricultural Marketing Service has oversight responsibilities for USB and the Soy Checkoff. For more information on the United Soybean Board, visit unitedsoybean.org.

About the U.S. Soybean Export Council (USSEC):

The U.S. Soybean Export Council (USSEC) focuses on differentiating, elevating preference, and attaining market access for the use of U.S. Soy for human consumption, aquaculture, and livestock feed in more than 90 countries internationally. USSEC members represent the soy supply chain including U.S. Soy farmers, processors, commodity shippers, merchandisers, allied agribusinesses, and agricultural organizations. USSEC is funded by the U.S. Soy Checkoff, USDA Foreign Agricultural Service matching funds, and industry. Visit www.ussec.org for the latest information about USSEC and U.S. Soy internationally.

Source: USDA, Global Agricultural Trade System (GATS), January 2026

###

[1] https://www.fas.usda.gov/data/venezuela-livestock-and-products-annual-6

[2] https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds+and+Products+Annual_Dhaka_Bangladesh_BG2024-0001.pdf

[3] https://ers.usda.gov/data-products/charts-of-note/chart-detail?chartId=95111#:~:text=10/10/2019-,India,Barriers%2C%20released%20in%20October%202019.